🏢 How to Register a Company in Nepal (2025 Guide) – Full Process, Fees & Timeline

Planning to start a business in Nepal? This complete guide explains how to register a company step-by-step, including required documents, fees, tax details, and estimated time for approval.

📌 Introduction: Why Company Registration Matters

Registering a company in Nepal is the first legal step toward building a successful business. Whether you’re launching a tech startup, trading firm, or e-commerce platform like SajhaDokan.com, proper registration ensures:

- Legal recognition

- Tax compliance

- Access to banking and investment

- Protection of brand and assets

This guide covers everything you need to know to register a company with Nepal’s Office of the Company Registrar (OCR).

✅ Types of Companies You Can Register in Nepal

| Type of Company | Description |

|---|---|

| Private Limited | Most common; 1–50 shareholders |

| Public Limited | Can issue shares to the public |

| Non-Profit Company | For social, educational, or charitable purposes |

| Partnership Firm | Registered under the Partnership Act |

| Sole Proprietorship | Small businesses, registered at local ward office |

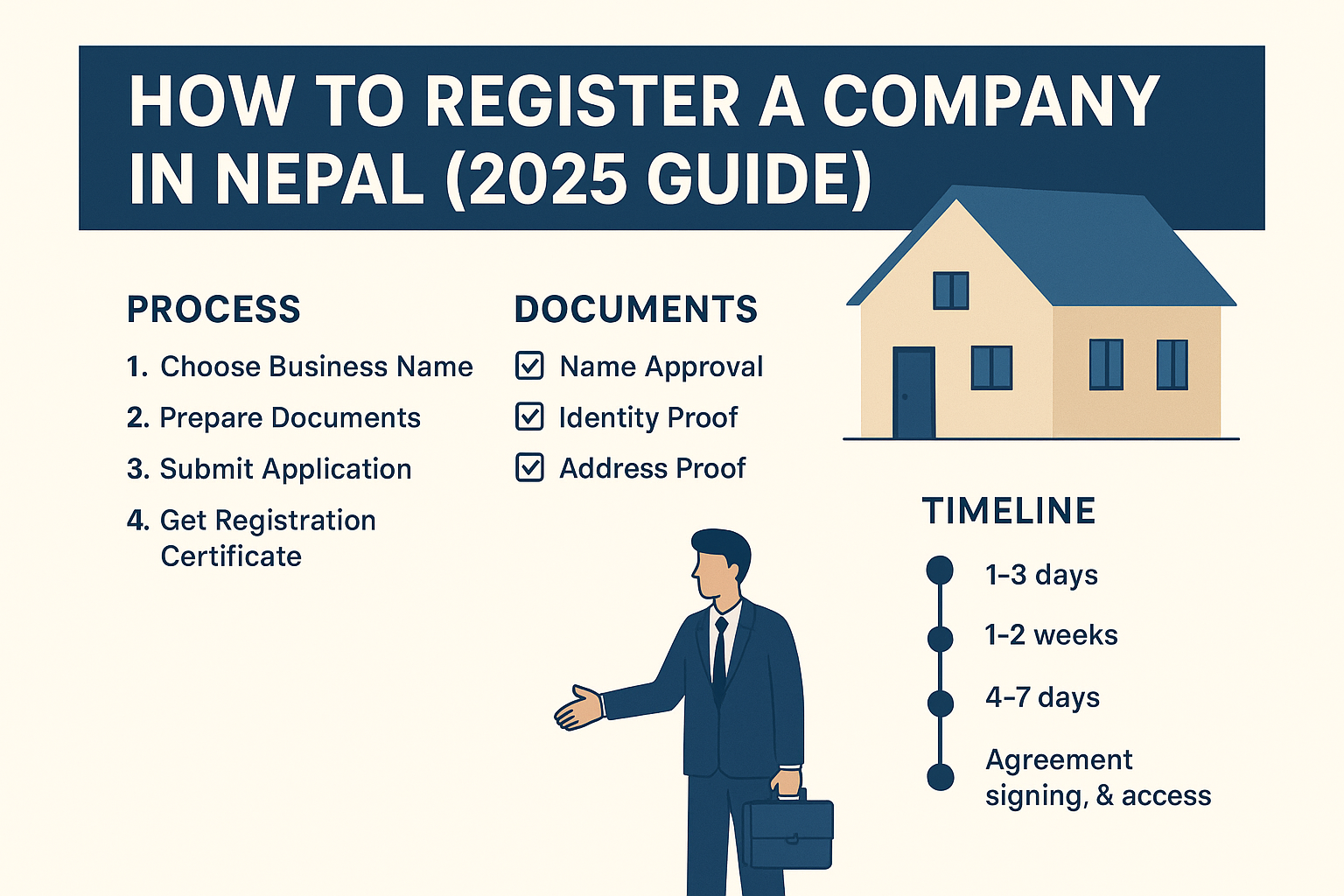

📝 Step-by-Step Company Registration Process

1. Choose a Unique Company Name

- Visit ocr.gov.np

- Use the Name Check Tool to verify availability

- Reserve your name online (valid for 35 days)

2. Prepare Required Documents

For Private Limited Company:

- Application form (online or physical)

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Citizenship copies of shareholders

- Passport-size photos

- Shareholder agreement (if applicable)

- Rent agreement or utility bill of office address

- PAN registration form

3. Submit Application to OCR

- Upload documents via OCR portal

- Pay registration fee based on authorized capital

- Wait for verification and approval

4. Get Certificate of Incorporation

- Once approved, OCR issues a Company Registration Certificate

- You’ll also receive a PAN/VAT number from Inland Revenue Department

5. Open a Bank Account

- Use your registration certificate and PAN to open a corporate bank account

- Deposit initial capital (if required)

6. Register for Tax (VAT/TDS)

- Visit the Inland Revenue Office

- Register for VAT (if annual turnover exceeds NPR 2 million)

- Get TDS registration for employee salaries and vendor payments

💰 Estimated Registration Fees in Nepal (2025)

| Authorized Capital (NPR) | Registration Fee (NPR) |

|---|---|

| Up to 1 million | 1,000 |

| 1–5 million | 4,500 |

| 5–10 million | 9,000 |

| 10–20 million | 16,000 |

| Above 20 million | 23,000+ |

Other Costs:

- PAN Registration: Free

- VAT Registration: Free

- Legal drafting (MOA/AOA): NPR 2,000–5,000 (if outsourced)

- Rent agreement notarization: NPR 500–1,000

📅 Estimated Timeline

| Task | Time Required |

|---|---|

| Name Reservation | 1 day |

| Document Preparation | 2–3 days |

| OCR Submission & Approval | 5–7 working days |

| PAN/VAT Registration | 2–3 working days |

| Bank Account Setup | 1–2 days |

Total Time: Approx. 10–15 working days

🧾 Tax Responsibilities After Registration

| Tax Type | Description |

|---|---|

| Corporate Tax | 25% on net profit (Private Limited) |

| VAT | 13% on taxable goods/services |

| TDS | 1–15% depending on payment type |

| Social Security | Mandatory for companies with salaried employees |

💡 Expert Tips for Smooth Registration

- Choose a name that reflects your brand and is easy to remember

- Use a legal expert for MOA/AOA drafting

- Keep scanned copies of all documents ready

- Register your domain name and social media handles early

- Maintain proper accounting from day one

📌 Conclusion

Registering a company in Nepal is a straightforward process if you follow the right steps. With proper documentation, legal compliance, and tax registration, you can launch your business confidently and legally.

Whether you’re starting a tech firm, trading company, or online store like SajhaDokan.com, this guide ensures you’re ready to build your brand with full legal backing.